From Gail Tverberg via OurFiniteWorld.com:

(SEE MY COMMENTS AT THE END OF THIS SYNOPSIS.)

“It has recently become clear to me that heavy oil, which is needed to produce diesel and jet fuel, plays a far more significant role in the world economy than most people understand.“

“Leaders may think that they are in charge, but their power to change the” way the overall system works, in the chosen direction, is quite limited. The physics of the system tends to keep oil prices lower than heavy oil producers would prefer. It tends to cause debt bubbles to collapse.“

“[1] The most serious issue with oil supply is that there seems to be plenty of oil in the ground, but the world economy cannot hold prices up sufficiently high, for long enough, to get this oil out.

- Heavy oil is especially involved in this affordability issue. As oil becomes “heavier,” it becomes more viscous, and thus more difficult to ship by pipeline. If oil is very heavy, as is the oil from the Oil Sands of Canada, it needs to be mixed with an appropriate diluent to be shipped by pipeline.

- [The] vast majority of reported oil reserves (85%) are held by non-OECD countries. These reserves may be significantly overstated.

- Also, even if the reserves are fairly reported, will the country have the resources to extract these reserves?

- Going forward, oil companies everywhere need to worry about broken supply lines for necessary items, such as steel drilling pipe. They need to worry about finding enough trained workers. They need to worry about the availability of debt and the interest rate that will be charged for this debt.

“[2] While oil producers can crack heavy oil to make shorter hydrocarbons in a way that is not terribly expensive, trying to make near-gasses and light oils into diesel becomes impossibly expensive.

“[3] If there is inadequate oil supply, the impacts on the economy are likely to include broken supply lines, empty shelves, and inflation in the price of goods that are available.

“[4] The fact that the quantity of oil that could be affordably extracted was likely to fall short about now has been known for a very long time, but this fact has been hidden from the public.

- In 1957, Hyman Rickover of the US navy predicted that the amount of affordable fossil fuels would fall short between 2000 and 2050, with the amount of oil falling short earlier than coal and natural gas.

- The book The Limits to Growth by Donella Meadows and others, published in 1972, discusses the result of early modeling efforts with respect to resource limits. These resource limits were very broadly defined, including minerals such as copper and lithium in addition to fossil fuels.

- A range of indications were produced, but the base model (based on business as usual) seemed to show limits hitting before 2030.

- Since the resource limits include minerals of all types, these limits would seem to preclude a transition to clean energy and electric cars.

- Politicians and government officials wanted to keep voters happy, so the self-organizing economy pushed them in the direction of keeping the story from the public.

- They tended to focus on climate issues instead.

- They added biofuels to stretch the supply of gasoline, and to a lesser extent, diesel.

- They also increased the share of natural gas liquids.

- The selling price of these liquids tends to be quite low, relative to the price of crude oil.

- They started providing reports showing “all liquids” rather than “crude oil,” in the hope that people wouldn’t notice the change in mix.

“[5] The world’s number one problem today seems to be an inadequate supply of Middle Distillates. These provide diesel and jet fuel.

- Diesel and jet fuel provide the big bursts of power that commercial equipment requires. Many types of equipment are dependent on Middle Distillates, including semi-trucks, agricultural equipment, ocean-going ships, jet planes, road-making equipment, school buses, and trains operating in areas with steep inclines.

- Because of its concentrated store of energy, diesel is also used to operate backup generators and to provide electricity in remote areas of the world where it would be impractical to have year-round electricity without an easily stored fuel.

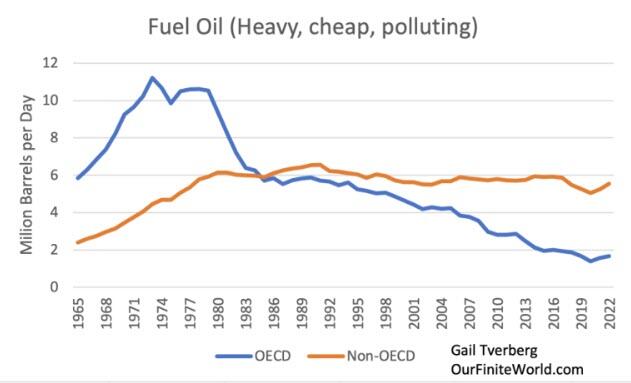

In [the figure above]:

- Light Distillates are primarily gasoline (78% in 2022).

- Middle Distillates are diesel (82%) and jet fuel/kerosene (18%).

- Fuel Oil is a cheap, polluting, unrefined product. If environmental laws permit, it can be burned as bunker fuel (used in ships), as boiler fuel, or to provide electricity.

- The Other category includes near-gasses such as ethane, propane, and butane (58%). It also includes some very heavy oil used as lubricants, asphalt, or feedstocks for petrochemicals.

- Until recently, it has been possible to increase diesel production by refining an added share of Fuel Oil. Fuel oil is quite heavy (barely a liquid), so it is well-suited to be refined into a mix that includes a large share of Middle Distillates.

- Now we are running short of Fuel Oil to refine for the purpose of producing more Middle Distillates. The Fuel Oil that is still consumed is used in what I think of as the poorer countries of the world: the non-OECD countries.

- Poor countries tend to value ‘low price’ over ‘prevents pollution.’

- It is likely to be difficult to get these countries to move away from the use of Fuel Oil.

“[6] Countries around the world are now competing for Middle Distillates to maintain the food production, road building, commercial transportation, and construction portions of their economies.

- Growth in usage tends to be higher for Middle Distillates than Light Distillates. The total quantity consumed is also higher for Middle Distillates.

- Diesel and jet fuel, made using Middle Distillates, are less on the minds of voters, but they are probably more important to the economy because people’s jobs depend upon the economy in its current form holding together.

- Inadequate Middle Distillates leaves empty shelves in stores because of broken supply lines. It also leads to inflation of the type we have recently been experiencing.

- Indirectly, lack of Middle Distillates can lead to debt bubbles collapsing, and to problems of a different type than inflation.

- Up until 2007, Middle Distillate consumption was generally increasing for both OECD countries and non-OECD countries. The Great Recession of 2008-2009 particularly affected OECD countries. European countries found their economies doing less well. For example, less diesel was used to operate tour boats carrying tourists; a larger share of available jobs were low-paid service jobs.

- The year 2013 was a turning point of a different type. The consumption of non-OECD countries caught up with that of OECD countries. While non-OECD countries might like to maintain their rapid upward trajectory in the consumption of Middle Distillates, this no longer seems to be possible.

“[7] Under the Maximum Power Principle, the physics of the economy pushes the economy toward optimal low-cost solutions, especially as the quantity of Middle Distillates approaches limits.

- Because the economy favors the lowest cost of profitable production, a person would expect that warm countries that use oil sparingly in their energy mix (India, the Philippines, and Vietnam, for example) would have a competitive edge over other countries in manufacturing.

- In general, a person would expect non-OECD countries to outcompete OECD countries, especially if cheap fuel for manufacturing is available. The lack of cheap fuel is increasingly becoming a problem in many parts of the world. Coal used to be cheap, but its price can now spike. Natural gas prices can also spike, especially if natural gas is purchased without a long-term contract. Electricity using wind and solar tends to be high-priced, too, when the cost of transmission is included.

“[8] The Maximum Power Principle seems to be pushing the EU away from diesel.

- The EU has a serious oil problem. It has essentially no crude oil production of its own. Furthermore, oil production in Europe outside of the EU (mainly the UK and Norway) has been falling since 1999, greatly reducing the possibility of imported oil from this area.

- When I look at the data regarding the types of oil the EU has chosen to consume (nearly all imported), I find that it uses an oil mix that is unusually skewed toward Middle Distillates and away from Light Distillates.

- Part of the reason the EU uses this skewed oil mix is because it has encouraged the use of private passenger cars using diesel through its tax structure.

- Underlying this tax structure was most likely an understanding that Russia, through its exports of Urals Oil, which is heavy, could provide the EU with the mix of oil products it needed, including extra diesel.

- The EU has recently cut off most oil imports from Russia as a way of punishing Russia. This cutoff is being phased in, with most of the impact in 2023 and later.

- China and India are now buying most of Russia’s exported oil. These countries tend to use the oil more “efficiently” than the EU. In particular, they do more manufacturing than the EU, and they have far fewer private passenger cars per capita than the EU.

- If diesel is in short supply, efficiency demands that it should be saved for uses that require it, such as powering heavy equipment.

- Because of the efficiency issue, I doubt that the EU will be able to continue importing as high a diesel mix in the future as it has been importing up to now.

“[9] The substitution of electricity for oil so far has been mostly in the direction of replacing gasoline usage for private passenger automobiles. Substitution of electricity for Middle Distillates would be virtually impossible.

- Oil is a mixture of different hydrocarbon lengths. Substitution of electricity for one part of the hydrocarbon mix, namely for the Light Distillates, is not very helpful.

- Oil companies need to be able to sell all parts of the mix in order to make their extraction efforts worthwhile.

- If oil companies find themselves without buyers for most Light Distillates, they would have difficulty recouping their overall costs.

- There would be a possibility of oil production stopping. Without oil, farming would mostly stop. Road repair would stop. Today’s economy would come to a halt.

- Of course, as a practical matter, the vast majority of the world will pay no attention to mandates that all private passenger automobiles be EVs.

- Buyers in most parts of the world will make decisions based on which cars are least expensive to own and operate. As a result, there is little chance of private passenger cars being completely replaced by EVs.

- Instead, EV mandates in some countries may somewhat reduce the selling price of gasoline worldwide because these drivers are no longer using gasoline.

- With lower gasoline prices, non-EV’s are likely to become cheaper to operate in countries where they are permitted, boosting their sales. This is an effect similar to Jevons Paradox.

“[10] There are many related topics that could be addressed, but they will need to wait until later posts.

- The world economy is tightly networked together. Oil prices likely won’t rise a whole lot higher, for very long, if the economy is forced to shrink.

- Inadequate oil supplies per capita also tend to cause fighting among countries. OECD countries seem to over consume, relative to the benefits they provide to the rest of the world.

- If a local economy chooses to increase energy costs by taking steps to reduce its carbon footprint, the main impact may be to disadvantage the local economy relative to the world economy.

- I expect that the members of the EU and other rich nations will be the primary countries pursuing carbon reduction technologies. Poorer economies may pay lip service to carbon reduction, but they will tend to focus primarily on increasing the welfare of their own people, whether or not this requires more carbon.”

THE AVERAGE PERSON HAS LITTLE AWARENESS OF THE CHALLENGES INHERENT IN FUTURE ENERGY USAGE. INSTEAD, S/HE JUST GOES ABOUT LIFE ASSUMING THAT WHATEVER ENERGY IS NEEDED IN THE MOMENT WILL AUTOMATICALLY BE AT HAND.

YESTERDAY, WHILE DRIVING TO A LAWN PARTY THROUGH THE SUMMER-LUSH SMITHFIELD VALLEY — FLANKED AS WE WERE BY HORSE FARMS, CATTLE HERDS, CORNFIELDS AND ROWS OF OTHER CASH CROPS — I NOTICED THAT OUR SERENELY WINDING TWO-LANE ROUTE 5 HAD JUST RECEIVED A FRESH COAT OF ASPHALT.

THIS SHINY NEW LAYER WAS, IN FACT, SO FRESH THAT IT HADN’T YET SETTLED INTO THE ROADBED. NOR HAD THE COUNTY PAINTED IN THE ROAD’S WHITE LINES.

YET, IF THE DECARBONIZATION ZEALOTS IN THIS STATE HAD MAGICALLY HAD THEIR WAY, AND WE’D BECOME BY NOW A DECARBONIZED JURISDICTION, HOW MIGHT THAT BEAUTIFUL VALLEY ROAD HAVE BEEN AS ECONOMICALLY UPGRADED? IN FACT, WOULD IT HAVE BEEN UPGRADED AT ALL?

NOT TO MENTION WHAT EFFECT INSTANT DECARBONIZATION WOULD HAVE HAD ON THE AGRICULTURAL ECONOMY OF THAT VITALLY RURAL VALLEY.

AND IT’S NOT JUST ROADS AND FARMING. 80% OF THE THINGS WE ALL USE IN DAILY LIFE ARE PETROLEUM DERIVED. THINK ABOUT THAT THE NEXT TIME YOU START FRETTING ABOUT HIGH TEMPERATURES AND REACHING FOR MAGICAL SOLUTIONS TO CLIMATE CHALLENGES.

ECONOMIC LIFE MUST GO ON, AND IT WILL GO ON, REGARDLESS OF HOW WELL WE DEAL WITH OUR ENVIRONMENTAL PROBLEMS OR NOT.

One response to “The Heavy Oil/Diesel Predicament”

[…] https://manhattanbridgeblog.wordpress.com/2023/08/06/the-heavy-oil-diesel-predicament/ […]

LikeLike